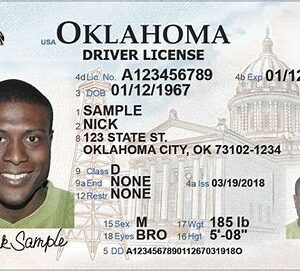

oklahoma tax id

Success with an Oklahoma Tax ID: Your Key to Financial Stability

Starting a business in Oklahoma is an exciting endeavor, but navigating the tax requirements can often feel overwhelming. However, with an Oklahoma Tax ID, you can streamline the process and ensure compliance with state regulations. Our service is dedicated to providing you with the support and resources you need to obtain your tax ID quickly and easily, setting you on the path to financial success.

Why Choose an Oklahoma Tax ID?

- Legal Compliance: In Oklahoma, businesses are required to obtain a tax ID for various purposes, including filing taxes, hiring employees, and conducting financial transactions. Obtaining your tax ID ensures that you’re operating legally and avoids potential penalties for non-compliance.

- Business Growth: With a tax ID in hand, you can establish your business identity, build credibility with customers and partners, and access essential financial services. Whether you’re a sole proprietor, corporation, or partnership, having a tax ID opens doors to growth and expansion opportunities.

- Financial Management: Your tax ID serves as a unique identifier for your business, allowing you to separate personal and business finances effectively. With a dedicated tax ID, you can track income, expenses, and deductions more efficiently, making tax preparation and financial planning easier than ever.

- Professional Image: Displaying your tax ID instills confidence in customers, vendors, and lenders, demonstrating your commitment to professionalism and accountability. Whether you’re seeking financing, signing contracts, or applying for permits, a tax ID enhances your business’s reputation and credibility.

Simple Steps to Obtain Your Oklahoma Tax ID:

- Visit Our Website: Begin the process of obtaining your Oklahoma Tax ID by visiting our user-friendly website. Here, you’ll find all the information and resources you need to navigate the application process effortlessly.

- Complete the Application Form: Fill out the online application form with your business information, including your legal business name, business structure, address, and contact details. Ensure that all information is accurate and up-to-date to avoid delays in processing.

- Provide Supporting Documents: Depending on your business structure and industry, you may need to provide additional documentation to support your application. This may include articles of incorporation, partnership agreements, or other legal documents.

- Submit Your Application: Once you’ve completed the application form and gathered the necessary documents, submit your application through our secure online portal. Double-check all information for accuracy before finalizing the submission.

- Pay the Fee: Pay the applicable fee for your Oklahoma Tax ID application. Accepted payment methods may vary, so be sure to review the options provided on our website.

- Confirmation and Processing: After submitting your application and payment, you’ll receive a confirmation email acknowledging receipt. Our dedicated team will then begin processing your application promptly, ensuring timely issuance of your tax ID.

- Receive Your Tax ID: Once processed, your Oklahoma Tax ID will be issued and sent to you via email or mail, depending on your preference. Keep this ID in a safe place and use it for all tax-related purposes and business transactions.

Order Your Oklahoma Tax ID Today:

Don’t let the complexities of tax compliance hinder your business success. With our streamlined application process and expert support, obtaining your Oklahoma Tax ID is quick, easy, and stress-free. Follow these simple steps on our website, and unlock the financial stability and growth opportunities that come with having a tax ID for your business. Order yours today and take the first step towards building a thriving business in Oklahoma.

Showing the single result